Top 12 Film Industry Stories of 2012: #1

The Force Is with Disney

By David Mumpower

January 9, 2013

BoxOfficeProphets.com

The core of Lucasfilm, the Star Wars franchise, has earned $4.5 billion from global box office sales alone. It has earned an additional $3.8 billion from home video, $2.9 billion from videogame licenses, $1.8 billion from book sales and $1.3 billion via other revenue streams. That’s a rough estimate of $14.3 billion over the course of the franchise’s 35 years in existence. And you will notice that I left out a key component in the calculations above.

Toy sales comprise the overwhelming majority of annual Star Wars sales. Estimates place total toy sales for Star Wars north of $12 billion. While no one outside of Lucasfilm’s accounting office will ever know for sure, these numbers are semi-confirmed by Forbes Magazine. They also note that in 2011 alone, Star Wars sold $1.5 billion worth of toys and games.

To put this number in perspective, consider that Star Wars: Episode I – The Phantom Menace is the best box office performer of the six movies made thus far. Its worldwide gross is just over a billion dollars. In 2011, Star Wars as an intellectual property for merchandising earned 50% more through toy sales alone. This happened despite the fact that there had not been a Star Wars movie since 2005. Star Wars as a movie is a Trojan horse of sorts. The aftermarket is where George Lucas has sold enough ancillary Star Wars merchandise to become a billionaire.

In the merchandising world, there is one heavyweight that lords above all others. Disney has mastered the art of selling toys to children. In 2011 alone, Disney sold $37.5 billion worth of retail licensed products. The next closest global competitor managed “only” $12 billion. Yes, Disney has tripled its nearest competitor. Even the vaunted toy distributor, Mattel, grossed a modest $7 billion in sales in 2011, over $30 billion short of Disney in the same calendar year. Mickey Mouse has lapped the competition in every conceivable way.

The problem with possessing a de facto monopoly on global sales is finding new avenues for growth. In August of 2009, Disney attempted to correct a longstanding flaw in their internal economy. Disney toy sales have historically skewed to girls because of iconic princess characters in their film library. Disney Princesses are the top merchandising items in the world, after all. In the 2000s, the company has actively sought to create more of a toy sales balance between girls and boys.

The corporation accidentally stumbled into a solution for this when they purchased Pixar Animation Studios in 2006. The price tag was a respectable $7.4 billion. No one questioned the value of this proposition since Pixar was the gold standard in family fare at the time. A few months later, Cars was released into theaters and by the end of the year, Lightning McQueen and Mater had become two of the hottest toys on the market. Boys loved Cars merchandise to the point that an argument could be made that Disney has broken even on its $7.4 billion Pixar purchase through Cars toys alone.

Emboldened by this tactic, Disney started looking for other popular brands that would appeal to boys. Over three years later, some industrious employee deduced the perfect target. Disney shocked financial analysts around the world by acquiring Marvel Entertainment for $4 billion. While the movie distribution system of the company has been joygasmic over this decision, the toy sales are what drove the purchase.

Consider that in 2009, Disney merchandising was worth $27.2 billion; sales increased to $28.6 billion in 2010. And you already know that the number spiked to $37.5 billion in 2011. That’s over $10 billion in growth in two calendar years. Marvel is obviously not responsible for all of that but the sudden prevalence of Thor and Captain America dolls on the shelves undeniably helped.

In 2011 alone, Marvel licensing added $6 billion to the coffers, 50% more than what Disney paid for the property only two years before. Also, keep in mind that all of this occurred prior to the blockbuster release, The Avengers. Marvel’s licensing sales for 2012-2013 are going to be much stronger now that The Avengers is the third best-selling movie of all time. Marvel merchandising is worth exponentially more today than it was only a year ago.

Disney leadership never rests in their pursuit of revenue opportunities. Having hit homeruns with both Pixar and Marvel, their strategists examined other potential properties they could possibly purchase. One stood out from the rest. The holy grail of merchandising opportunities was Star Wars.

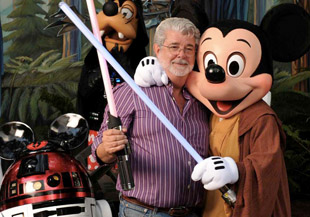

On October 30, 2012, news leaked of an impending Disney press conference. The major announcement was a jaw dropper. George Lucas had agreed to sell the masterwork of his lifetime, Lucasfilm Ltd., to Disney for $4.05 billion in cash and stock options. Yet again, Disney had achieved the impossible, purchasing a lucrative brand before potential competitors knew it was in play. They thereby avoided a bidding war and gained unquestionably the best independent movie license in the industry, Star Wars.

Obviously, Lucasfilm Ltd. includes more than just that movie franchise. Simply by adding Industrial Light & Magic, the special effects company created by Lucas, Disney created a new level of vertical integration within their company. By owning ILM, far and away the best special effects company in the business, the Mouse House instantly reduced the costs of all their major upcoming blockbusters. They will no longer be forced to pay third party pricing for their special effects. Conversely, they can overcharge competing studios who will also continue to use ILM for their needs, thereby offsetting some of the cost in acquiring Lucasfilm. This is an arcane asset.

The more tangible asset for Disney is the ability to create more Star Wars movies. Simultaneous with the announcement of purchase, CEO Bob Iger offered glorious news to fans of Lucas’ storied franchise. A new movie will be released in 2015, the first of a long rumored trilogy concluding Lucas’ initial story arc from the 1970s. Three more movies combined with ever-increasing film ticket prices and overseas revenue potential means that the new trilogy alone should gross $3 billion in global box office. Disney also intends to create television programming for their networks, which include the Disney Channel (natch), Disney XD and ABC. The Star Wars universe will be ubiquitous in coming years.

Amazingly, all of the above borders on irrelevant. What matters the most here is that the world’s largest toy merchandiser has just acquired the most coveted independent brand. Star Wars paraphernalia was already earning as much as $3 billion a year without Disney marketing. Sales should spike in coming years as Disney exploits previously untapped revenue potential. The initial financial outlay of $4.05 billion will border on negligible after only a few years, just as was the case with Disney’s purchases of Pixar and Marvel Entertainment.

In one fell swoop, Disney guaranteed more annual merchandising revenue. Always the philanthropist, George Lucas took a lot of that money and pledged to spend it on education. And the rest of us will get our first new Star Wars movie in a decade in 2015.

Simply put, there is nothing but upside to this transaction for Disney, George Lucas and pretty much all the rest of us. We the people win with Star Wars becoming a Disney property. We get more Star Wars while Disney picks our wallets clean, which they were already doing anyway.